We’ve all heard the saying, “It’s the thought that counts.” But let’s be honest, sometimes a gift doesn’t feel like a gift. Maybe the generic coffee mug screams last-minute buy, or the dusty fruitcake no one asked for. The truth is, gifts can backfire when they lack meaning, connection, or effort. Instead of delighting someone, they leave them wondering, “Did they even know me?”

This is even more important in workplaces. A thoughtful gift can strengthen relationships, boost morale, and show genuine appreciation. However, a poorly chosen one can feel like an obligation or an afterthought.

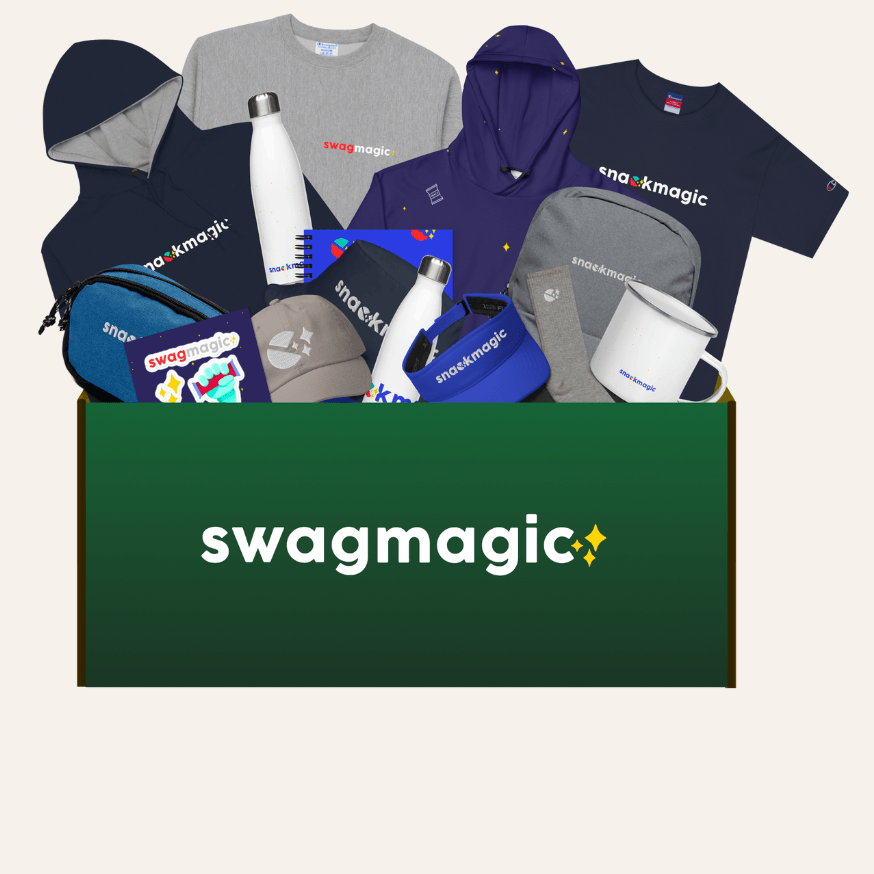

How SwagMagic can help your brand?

- Bulk Buy & Save on your gifts!

- Curate Customized Swag Boxes!

- Launch Your Store for your employees!

- Secure Swag Storage with us!

So, when does a gift stop being a gift? And how can you make sure what you give truly resonates? Let’s dive into the fine line between giving and giving something that matters.

Table of contents

The Story Behind a Gift

“When is a gift, not a gift?” In Dune, House Atreides receives Arrakis as a ‘gift,’ only to discover it’s a trap. This shows how the giver shapes meaning. In life and business, gifts given can sometimes feel transactional rather than heartfelt. That’s where SwagMagic helps—ensuring every item resonates with care, personalization, and impact. A true gift should never carry hidden strings but instead leave the recipient feeling valued, appreciated, and inspired.

- A gift not a gift happens when meaning is lost.

- The giver’s intention matters more than the object itself.

- Gifts given in business should build trust, not obligations.

- Thoughtless gifts may damage relationships instead of strengthening them.

- SwagMagic focuses on personalization to make every gift memorable.

- A meaningful gesture sparks loyalty and appreciation.

The Role of Taxes in Gifting

Curate the perfect box of handpicked gift they’ll love and send joy their way

While we see gifts as tokens of appreciation, certain transfers may be subject to gift tax. According to the Internal Revenue Service, a form of gift can trigger obligations if it surpasses specific thresholds. A well-intentioned gift may, therefore, involve more than emotions. SwagMagic simplifies this by focusing on thoughtful, personalized swag that keeps generosity free from stress—making sure businesses inspire their teams without stumbling into unnecessary complexities. Gifting should remain a joy, not a burden.

- A form of a gift can include money, property, or services.

- The IRS sets limits for when a gift may trigger reporting.

- Many people don’t realize that even small gestures may be subject to gift tax.

- Businesses must consider value thresholds before sending high-cost gifts.

- SwagMagic offers creative alternatives that avoid unnecessary complications.

- Thoughtful, affordable gifts can leave a stronger impression than expensive ones.

Understanding the Donor’s Responsibility

The donor carries the duty of compliance. In cases where gifts may be subject to taxation, businesses must decide how to handle obligations. Companies that agree to pay the gift tax avoid shifting responsibility to the recipient, keeping relationships positive. SwagMagic ensures appreciation stays meaningful without crossing into unintended complications. By balancing personalization and compliance, organizations can strengthen bonds with employees and clients while steering clear of obligations that make a kind gesture feel transactional.

- The donor is always responsible for reporting and compliance.

- A gift may be subject to rules even if the donor doesn’t realize it.

- Agree to pay the gift tax shows responsibility and respect.

- Passing tax obligations to the recipient can harm relationships.

- SwagMagic ensures gifts feel like appreciation, not liabilities.

- Responsible gifting maintains both compliance and goodwill.

Annual Exclusion Rules

Each year, the IRS allows gifting within limits. The transfer may be subject to gift reporting if you exceed the annual exclusion amount. For businesses, this can complicate a simple act of appreciation. SwagMagic helps keep gifting meaningful yet practical, offering swag that delights without raising concerns. By staying mindful of these thresholds, companies can avoid pitfalls while ensuring employees and clients receive thoughtful gestures that build loyalty and morale.

- The annual exclusion sets a safe value limit for gifts.

- Exceeding this amount means filing paperwork with the IRS.

- Businesses must track the value of employee and client gifts.

- Simple gifts can be more impactful than high-cost items.

- SwagMagic helps companies stay within safe gifting ranges.

- Thoughtful swag avoids compliance headaches while building morale.

Lifetime Exemption Considerations

Large transfers can exceed the lifetime gift tax exemption, leading to paperwork. In such cases, donors must file Form 709 to disclose the value. Sometimes, a business might pay the gift tax instead of the recipient. But if they exceed the lifetime gift tax, compliance gets even more complex. With SwagMagic, gifting stays far from these challenges—focused instead on personalized experiences, creative swag, and meaningful appreciation that uplift teams and clients without regulatory headaches.

- The lifetime gift tax exemption applies to large cumulative gifts.

- Exceeding this amount triggers long-term reporting responsibilities.

- Donors must file Form 709 for transparency with the IRS.

- Choosing to pay the gift tax instead protects recipients.

- Businesses rarely face these limits with thoughtful swag gifting.

- SwagMagic ensures gifting stays joyful and stress-free.

Gifting Made Simple with SwagMagic

Corporate appreciation doesn’t need to be tangled in tax rules. Instead of worrying whether your gestures may be subject to gift tax, SwagMagic ensures thoughtful gifts easily reach employees and clients. Our curated swag inspires, motivates, and engages, while keeping businesses safe from unnecessary complexity. With the right approach, gifting is never about obligation—it’s about connection. When chosen wisely, a gift becomes a powerful way to build loyalty, culture, and relationships that last.

- SwagMagic offers curated, personalized gifts for every occasion.

- Businesses avoid risks tied to compliance-heavy gifts.

- Employees feel valued through thoughtful, practical swag.

- Clients appreciate meaningful, non-transactional gestures.

- Easy customization makes gifting seamless for organizations.

- Gifting becomes a tool for culture-building, not confusion.

At the end of the day, the value of a gift lies in the thought behind it—not in the tax rules it might trigger. With SwagMagic, you can give employees and clients gifts that show appreciation, spark loyalty, and strengthen culture—without the stress. Ready to make gifting simple, meaningful, and memorable? Explore SwagMagic today and turn every gift into a true gesture of connection.